Is Shanghai shaping the future of automotive?

From chips to connectivity and plug-in hybrids, the Shanghai Auto Show offers a glimpse of a future that's closer than it seems.

Maybe the Shanghai Auto Show has never been an exotic fair for fans of Eastern car culture. But one thing is certain: its importance has grown, and today it stands as one of the most relevant showcases for understanding the world to come—at least in terms of mobility.

You'll find electric models, new-generation hybrids, autonomous driving technologies, and digital innovations: China is openly displaying its industrial ambitions. And this matters to us, as became evident during the latest edition, which wrapped up on Friday, May 2.

The streets of our cities are still dominated by German, French, and Italian brands, but over the past twenty years, China has gained more than 30 percentage points in global car production share. Europe has lost ground, while Beijing has already become the world’s third-largest car exporter.

In other words, if we try to imagine what cars will look like in 2054, it's not at all far-fetched to think they might be Chinese.

A Matter of Chips

Of course, this doesn’t mean there are no issues. As the Wall Street Journal reported, China still heavily depends on American chips for cars and many industrial products. Despite the patriotic push and the effort to “use Chinese chips and love Chinese chips,” the Chinese government had to exclude eight categories of U.S. semiconductors from its new tariffs in the ongoing trade war.

It did so under pressure from local carmakers, which rely on microcontroller units (MCUs) and analog chips, often supplied by companies like Texas Instruments, NXP, STMicroelectronics, and Renesas.

But that doesn’t mean China isn’t pushing forward—quite the opposite. It’s accelerating toward domestic chip production to supply the very cars it builds.

Data Analysis

According to BIP’s analysis of data from the Observatory of Economic Complexity, China’s rise as a car exporter is striking. In 2003, it ranked 38th, with just $0.153 billion in car exports. By 2023, it had soared to 3rd place, with $74 billion—and that’s just for passenger cars.

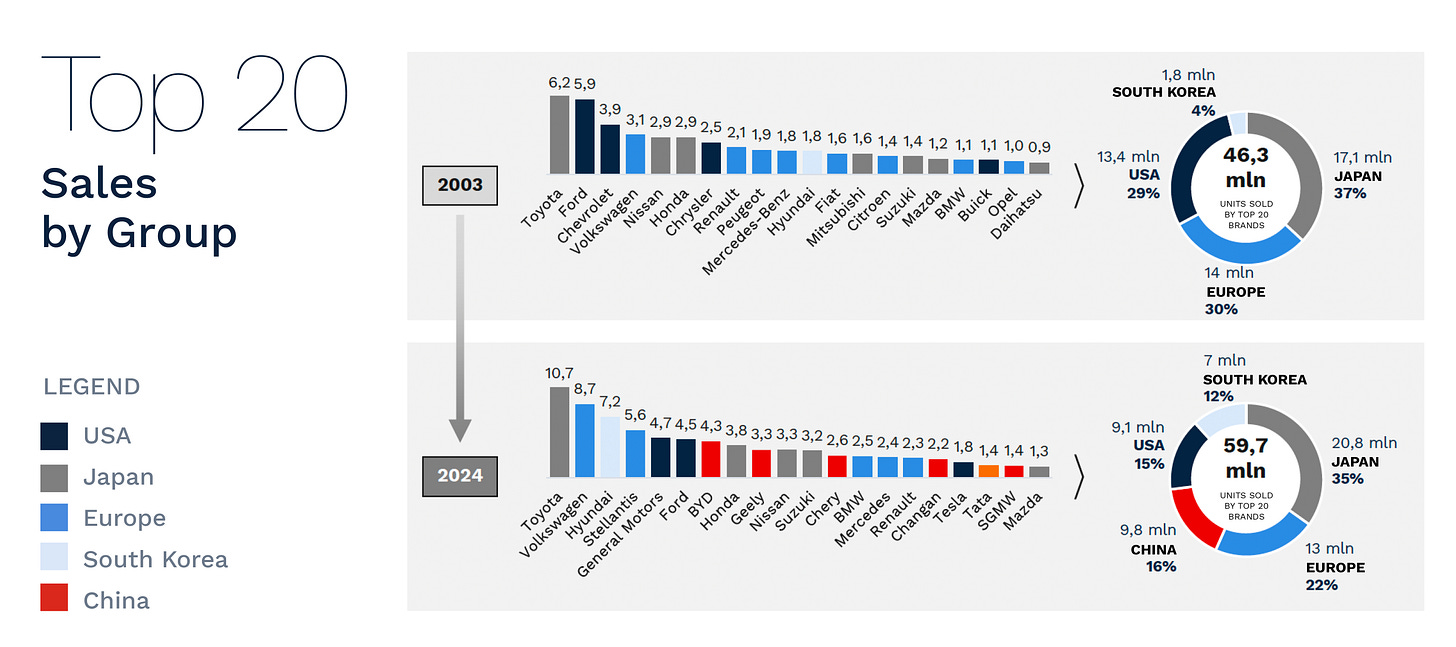

A similar shift can be seen in global car sales by region. In 2003, none of the world’s top 20 best-selling car brands were Chinese. The market was dominated by Japan (37%), Europe (30%), the United States (29%), and South Korea (4%).

Just over twenty years later, in 2024, the landscape looks like this: Japan (35%), Europe (22%), China (16%), United States (15%), and South Korea (12%).

And so, a once-distant event like the Shanghai Auto Show may soon become the true epicenter of the automotive world.

The Trends

This year, connectivity was also in the spotlight at the Shanghai Auto Show. The vehicles unveiled featured advanced driver-assistance systems (ADAS), using sensors, cameras, and onboard computers to monitor road conditions and help drivers avoid accidents or simplify driving.

There were also AI-powered smart dashboards. For instance, Volkswagen introduced a new automated driving system, tailored specifically to China’s complex traffic conditions.

BYD, on the other hand, showcased its "God's Eye" system—a comprehensive suite of driving-assistance features, including automated parking and highway autonomous driving.

Plug-in Hybrids

Shanghai also highlighted the growing role of plug-in hybrid vehicles (PHEVs)—cars that combine a traditional combustion engine with an electric motor. These can be charged via external sources like home sockets or public stations, allowing them to run fully electric for part of the journey.

In the first quarter of 2025, PHEV sales in China rose by 76%, reaching 3.4 million units. This boom is fueled by the demand for longer-range vehicles and the need to bypass the current limits of the charging infrastructure.

China is thus leading innovation not just in fully electric vehicles, but also in advanced hybrid solutions and increasingly sophisticated digital technologies.

Present and Future

It’s hard to say whether what we saw in Shanghai truly represents the global future of the car, or if mobility will head in different directions, possibly toward models where the car itself becomes less central.

It might still be too soon to consider this fair a privileged vantage point on the world of 2054. But one thing is certain: Shanghai tells us a lot about the present of the auto industry. And it proves, once again, that China is no longer a distant player. It is a central, connected, and increasingly close actor in shaping what’s next.

This content was contributed by Fabrizio Arena, Partner at BIP.

Could ChatGPT Help Test New Drugs?

According to TechCrunch, OpenAI—the company behind ChatGPT—has held discussions with the FDA (Food and Drug Administration), the U.S. federal agency responsible for regulating food and pharmaceutical products. The main topic was the “cderGPT” project, which may be linked to the CDER, the FDA division that certifies over-the-counter and prescription medications. The use of AI in this context could accelerate several phases of drug testing and development.

U.S. Imports Surge to Counter Tariff Risks

The U.S. trade deficit—the gap between the value of imports and exports—has doubled over the past year. According to Euronews, this trend is largely driven by the threat of new tariffs imposed by current President Donald Trump. One sector in particular has seen a sharp increase in imports: pharmaceuticals, which grew by approximately €20 billion in volume. As noted by Oxford Economics, most of these imports originate from Ireland.

Europe Aims to End Russian Gas Imports by 2027

This week, as reported by BBC, the European Commission unveiled a roadmap outlining that by 2027, no EU member state will import natural gas from Russia. To that end, EU Energy Commissioner Dan Jorgensen (Denmark) has called for new legislative proposals by June, in order to begin concretely reducing reliance on non-European energy sources.

The documentary produced by NIKKEI, Asia’s largest media group, explores the impact of China’s booming automotive sector through the lens of the Eastern market. In particular, it focuses on the effects in Thailand, known as the “Detroit of Asia,” and the structural transformation the Thai auto industry is undergoing in an effort to avoid decline.

Our word for this post is PHEV [Plug-in Hybrid Electric Vehicle]

PHEV, short for Plug-in Hybrid Electric Vehicle, refers to a type of hybrid car that combines an internal combustion engine with an electric motor that can be recharged externally. It's a bridge solution between traditional cars and fully electric vehicles.

Unlike conventional hybrids, PHEVs can be plugged into a power source—such as a home outlet or a public charging station—to recharge their battery. This allows them to travel several dozen kilometers in fully electric mode, without using any fuel.

This technology offers a practical alternative for those looking to cut fuel consumption and emissions, without giving up the flexibility of a combustion engine for longer trips. It’s a direct response to the current limits of charging infrastructure and the need for scalable solutions for more sustainable mobility.

In the global energy transition, PHEVs play a strategic role: they are accelerating the decarbonization of the automotive sector and promoting more conscious mobility habits, especially in urban environments.

Thanks for reading this far — your support means a lot.

Subscribe for free to this weekly newsletter and share the project with your network to help us grow.